Deportee Home Mortgages & Home Mortgages For British Deportees.

The option to take advantage of assets such as your financial investment portfolio, various other residential property and pension plans to work out even more flexible borrowing requirements as well UK MORTGAGE BROKER as interest rates. Our investment specialists constantly review the best methods to place your cash to function. Our portfolios are completely fluid, and you can access your money any time.

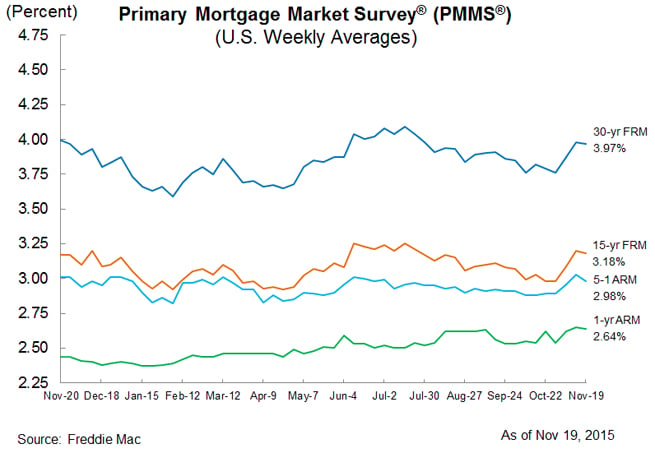

They would certainly been routed to a lender who located an offer of a repaired three-year expat price of 3.83% APR . But he had a complicated earnings stream, paid in an international currency, did not pay tax in the UK, as well as there were other MORTGAGE RATES UK one-of-a-kind lending demands. Taken care of rate mortgages ensure that their rate of interest will not transform for a set period, usually between one as well as 5 years.

Lawful Assisted Part And Part 2 Year Interest Only Fixed Rate Mortgages.

Find out more regarding these costs, together with just how much you can expect to pay, here. Utilize our mortgage calculator to promptly exercise just how much you might manage to purchase your next residence. With just a couple of simple information, we can reveal you how much you could be qualified to borrow, along 英國物業 with breaking down your month-to-month repayments. Cash advance can have a negative effect on your qualification for home mortgages, fundings, credit cards and more. There are various choices to consider if you are separating yet bound by a joint mortgage.

- You can also break out financial obligation recommendations at People Advice or the National Debtline.

- On the other hand, some lending institutions might offer first-time buyers a 100% home mortgage with a ₤ 0 down payment.

- Use our offset mortgage calculator to see just how your financial savings can lower your mortgage term or regular monthly repayments.

- You can exercise the complete quantity by adding up all of the costs of purchasing a home, detailed in our overview.

- As an example, UK financial institutions use a number of kinds of tracker mortgages, which are basically a type of variable rate home loan.

- Don't worry-- it only takes a few mins and also does not influence your accounts in any way.

Figure out how much you could borrow-- Our calculator gives an idea of what you can borrow, based upon your earnings and also outgoings. Figure out how we can sustain you if the influence of coronavirus on your funds has you stressed concerning making your home loan repayments. UK Home loan One belongs to Britain Link, a team of business with real monetary toughness that provides a range of consultancy solutions for all its customers over their UK BTL home profile. Join our "Home Mortgage One Gold" by having 72 hourspre-approval assurance as well UK MORTGAGE as easy detailed "Home loan ONE" application process making complete mortgage authorization within 30 days. Tax performance preparation is the keyfor UK Profile property owner and passion only repayment mortgage is the very best car loan architecture couple with. Solid 10+ specialist teamwith specialized sector knowledge in helping profile property managers growing their BTL building number by means of obtaining brand-new home loan or remortgage lendings.

Whatever your circumstance, there are a few things to be knowledgeable about when acquiring residential or commercial property in this country. For instance, if you're a newbie foreign buyer in the U.S.A. you may be needed to pay your initial year's home insurance coverage beforehand, as well as some regional tax obligations. Continue analysis CALCULATE MORTGAGE UK where we'll be covering how to obtain global mortgage loans in the UNITED STATES, what the American mortgage procedure includes for UK people, general details aboutbuying overseas. This company is established upon individual partnerships and also all of my candidates have direct access to me to ensure we give you the best possible solution.

Year Discount ₤ 999 Charge Cashback.

They'll go after up referrals, instruct your study and function as a central factor of contact for your application. Our completely certified specialists can use mortgage suggestions, assist you locate a lawyer or conveyancer, liaise with your estate representative providing basic house acquiring recommendations as well as save you a good deal of job. LONDON, May 4 - British home mortgage loaning showed the largest net increase on document in March after finance preacher Rishi Sunak prolonged a tax obligation cut for building 英國買樓按揭 acquisitions, Financial institution of England information revealed on Tuesday. Utilize our mortgage calculators to see just how much you can borrow, what it could cost you per month as well as compare mortgage prices. Searching for a home mortgage can be complicated, yet you could conserve time and money by using a home loan broker. When you acquire a residence, you'll take down a cash money down payment (usually a minimum of 5% of the property rate) and spend for the rest utilizing a home mortgage from a financial institution or structure culture.

Considered that home loan rates are additionally low, purchasing residential or commercial property using buy to allow may presently seem an appealing choice - especially if you utilize our buy to let mortgage contrast tables to find the most effective deal. Yet recent changes to buy to allow property tax guidelines have made it harder to earn a profit, because you need to pay more stamp obligation as well as can no more declare website tax obligation alleviation on your mortgage 英國按揭 passion repayments. With non interest-only buy to let home mortgages, investment accounts are one of the most common kind of payment strategy. However, for buy to allow property owners, the simplest method to pay back the principal is to sell the property at the end of the home loan term - as long as house rates have actually not decreased, certainly. LTV is the finance to worth ratio in between the amount you're obtaining and the value of the residence you're buying.

Is The Home Mortgage For A Co.

Customers across the UK rushed to make the most of the stamp obligation vacation. According to information from the Financial institution of England, mortgage authorization considerably increased especially after the initial lockdown. Second residence customers can likewise get the discounted rates, though they will certainly also be required to pay an additional 3% stamp obligation. In 2021, about 9 in 10 purchasers MORTGAGE BROKER UK are anticipated to pay no stamp obligation whatsoever. Additionally, loan providers examine a debtor's financial obligation tons as well as monthly outgoings. This presumes borrowers spend about 3% to 5% of their debt amount on monthly financial obligation service payments when loan providers carry out calculations.

New research study from energy firm Vattenfall reveals 61% of Brits believe home mortgages should be less expensive if they are lent on residences that discharge less emissions. There were 818,500 home loan authorizations over 2020, up from 789,100 the previous year, according to Financial institution of England information launched MORTGAGE CALCULATOR UK today. We can not recommend you on the viability of any kind of particular repayment technique. If you have any type of concerns pertaining to the viability of a settlement strategy, you should talk to an independent economic advisor.

Worldwide Mortgages.

Normally, the initial rule of mortgage rate of interest is that they're generally lower for people with higher down payments. So, if you have actually saved up a good chunk of the home worth, you will be rewarded with lower rate of interest. With a home mortgage you have interest to start paying promptly, and BUY TO LET MORTGAGE UK the worth of this can go up or down depending on the interest type you get on, the Financial institution of England base price and the home loan loan provider. Inform us your approximated building worth, your deposit figure, the term over which you wish to repay your home loan, as well as how much time you want to fix your interest rate for.